2022.11.22

2022.11.22

Recent styrene monomer market analysis and SM downstream products cost analysis

Bearish sentiment prevails across Asia’s petrochemical markets with no immediate end in sight on China’s zero-COVID strategy, which has been weighing on overall industrial activities of the world’s second-biggest economy.

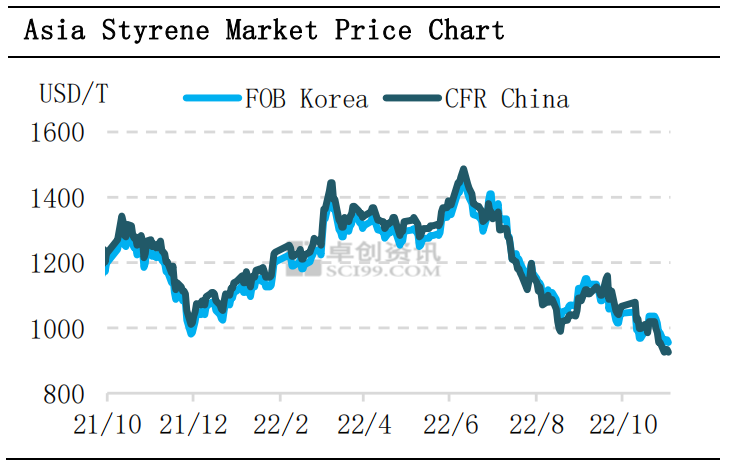

It can be seen from the above figure that the price of styrene has continued to fall in the past month. The main reason for the decline is that the focus of the pure benzene market continues to move downward, and the cost support is not good. At present, the domestic styrene inventory is relatively high, and the supply of goods to Hong Kong is more.

Price forecast –Drop down! Drop Down!

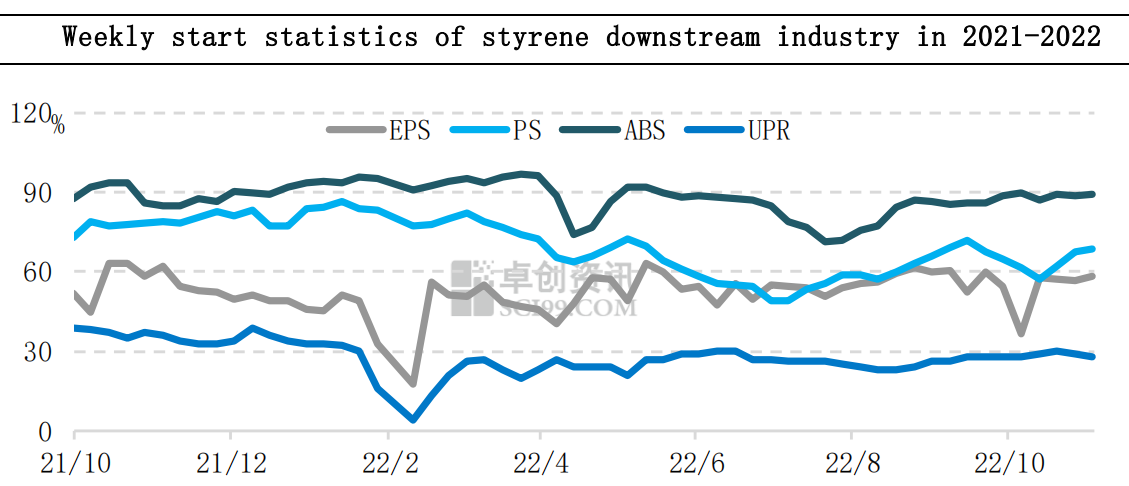

It is expected that the styrene market may slow down next week. From the perspective of supply, Baling has stabilized production after the restart, and Dagu will also restart as planned. It is expected that the output next week will increase by 1.6% compared with this week. At present, 34,200 tons of goods are expected to arrive next week, and the main port inventory may fluctuate within a narrow range. From the demand side, the start of construction of the three major S increased slightly this week, and little change is expected next week. In terms of raw materials, pure benzene may continue to be weak, and crude oil may fluctuate at a high level. Industry insiders currently have different views on the long and short market outlook. On the one hand, they believe that the bearish expectations of pure benzene have mostly been fulfilled, and the crude oil is high, so they are cautious in shorting; There are also risks of unplanned plant shutdowns and international oil prices

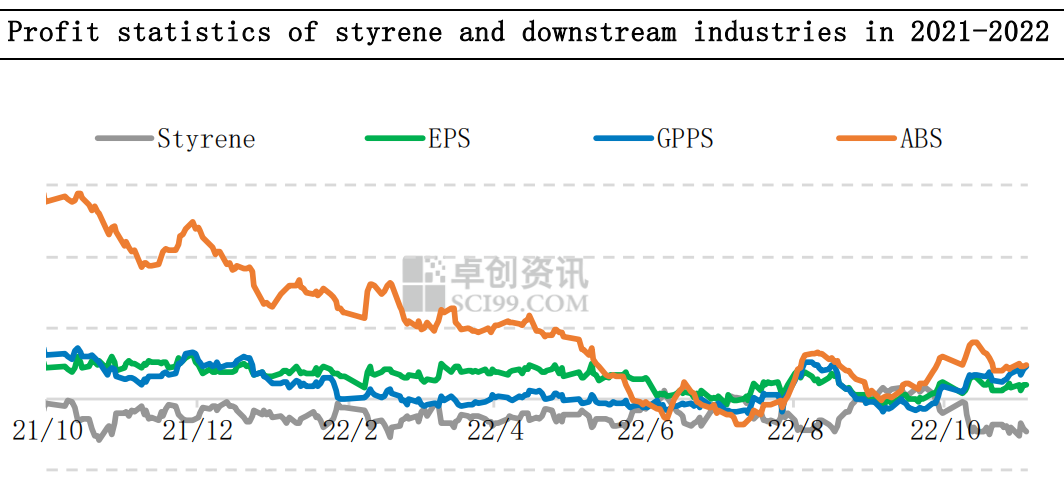

Downstream Product Cost Analysis

This week, the overall fluctuation of international oil prices was dominated by the pressure on US crude oil above US$90/barrel. The trend of oil prices is obviously entangled, mainly considering two factors: First, the market is waiting for the Fed to raise interest rates. Whether there is a discrepancy with market expectations is worth paying attention to. The interest rate hike will be scheduled on November 2. The rate and pace of interest rate hikes in the future are basically in line with market expectations. It did not cause significant disturbance to the oil market; second, the United States pressured oil companies to cut prices, which may impose a high profit tax, which may lead to pressure on oil prices, but the reduction in Saudi production and the decline in U.S. oil inventories provided support. Therefore, the market remains volatile.

The price of pure benzene market fluctuated downwards this week. The overall fluctuation of international oil prices this week is dominated by the obvious pressure above US$90/barrel of US crude oil, which has a certain negative impact on pure benzene. The arrival of pure benzene at the main port in East China has begun to increase. The new pure benzene unit is expected to produce products in mid-to-late November. At present, downstream styrene and caprolactam are still in losses, and the supply and demand structure continues to weaken, dragging down market confidence. This week, the focus of pure benzene prices fell.

Styrene monomer market outlook for next week

Crude oil: From the perspective of next week, the trend of oil prices is still tangled, and the market news is lacking. We will pay attention to whether there are positive factors to promote the upward breakthrough of oil prices. There are two potential positives. One is that the Fed raises interest rates by 75 basis points, and the subsequent interest rate hike releases a dovish signal. The macro pressure is temporarily relieved, and the market sentiment risk is slightly biased. The follow-up plan will be announced soon. Once announced, the market expects that demand will increase, and oil prices are expected to be strong. Therefore, there is a high probability that oil prices will remain volatile next week, but there are positive and possible rises during the period.

Pure benzene: Judging from next week, pure benzene may continue to be weak. There are still a lot of imported ships in East China, and the main port inventory may continue to increase. In terms of demand, under the mentality of buying up and not buying down, downstream factories mostly purchase on demand, and the overall demand is weak, which has a certain negative impact on the market. The short-term pure benzene market may continue to decline weakly.

Recent maintenance trends of styrene units outside of mainland China

|

Country |

Company |

Place |

Output(Million tons/year) |

Operation status |

|

USA |

Styrolution(INEOS) |

Bayport, TX |

77.1 |

Unexpected shutdown on January 20, 2022, the restart time in early April continued to be postponed, force majeure was declared in April, and the restart is being prepared. The ethylbenzene unit has been restarted successfully. At the end of May, the styrene unit was in the restart process and is currently in normal production; There is a small problem; work was suspended on July 26 due to power problems, and restarted in August; there was a short stop near September 19, and the current low-load production |

|

LyondellBasell |

Channelview,TX |

63 |

The maintenance started in April as planned, and the plant was restarted in June; the plant was shut down for a short time in September, and the current low-load production; in early October, the production was stopped due to profit problems, and it was restarted in mid-October, currently operating at low load |

|

|

Westlake |

Lake,Charles, LA |

26.1 |

The shutdown began on September 1, and the plant was restarted at the end of October |

|

|

Canada |

Styrolution(INEOS) |

Sarnia, Ont |

43.1 |

Overhaul in mid-May, restart on August 8 |

|

Korea |

Lotte chemical |

Daesan |

58 |

The load will be reduced by 20% to 80% in mid-February 2021, and the load will be reduced to 70% in June-July |

|

LG Daesan Chemical |

Daesan,South Korea |

18 |

Maintenance has been started around October 5, 2021, and it is reported that the shutdown plan |

|

|

Hanwha Total Petrochemical |

Daesan,South Korea |

|

It is reported that in early January 2022, the production will be reduced to 70%, and the production will be stopped at the end of March or early April, and restarted at the end of April. |